India's smartphone shipments had a record October

India's smartphone market registered a year-over-year (YoY) growth of 42% in October shipping 21 million units.

According to the International Data Corporation (IDC) India Monthly Smartphone Tracker, which tracks the monthly shipments into the market, this growth is 'massive'.

The growth was driven by multiple online sale festivals and continuing pent up demand from 3Q20. This is the highest ever October shipments and 2nd highest for a month, following 23 million units in September 2020, an all-time high for a single month.

- Apple phone-makers in India commit to $900 million investment

- Apple, Samsung among 16 companies get govt. approval to Make in India

No change in the pecking order, Xiaomi continues to top

As per the report, online channels, which enjoy 51% of the market, continued to grow by 53% YoY.

Offline channels, especially in smaller towns & cities, also saw a healthy 33% YoY growth.

The IDC report said that the low-midrange segment ($100-200) grew by 60% YoY, as its share increased to 58% of the total market.

Xiaomi, Vivo, and Samsung led with the Redmi 9, Note 9, and vivo Y20 as the top models.

The premium segment ($500-700) witnessed multifold growth with high shipments of the iPhone XR, 11 and OnePlus 8 driven by affordability schemes/offers.

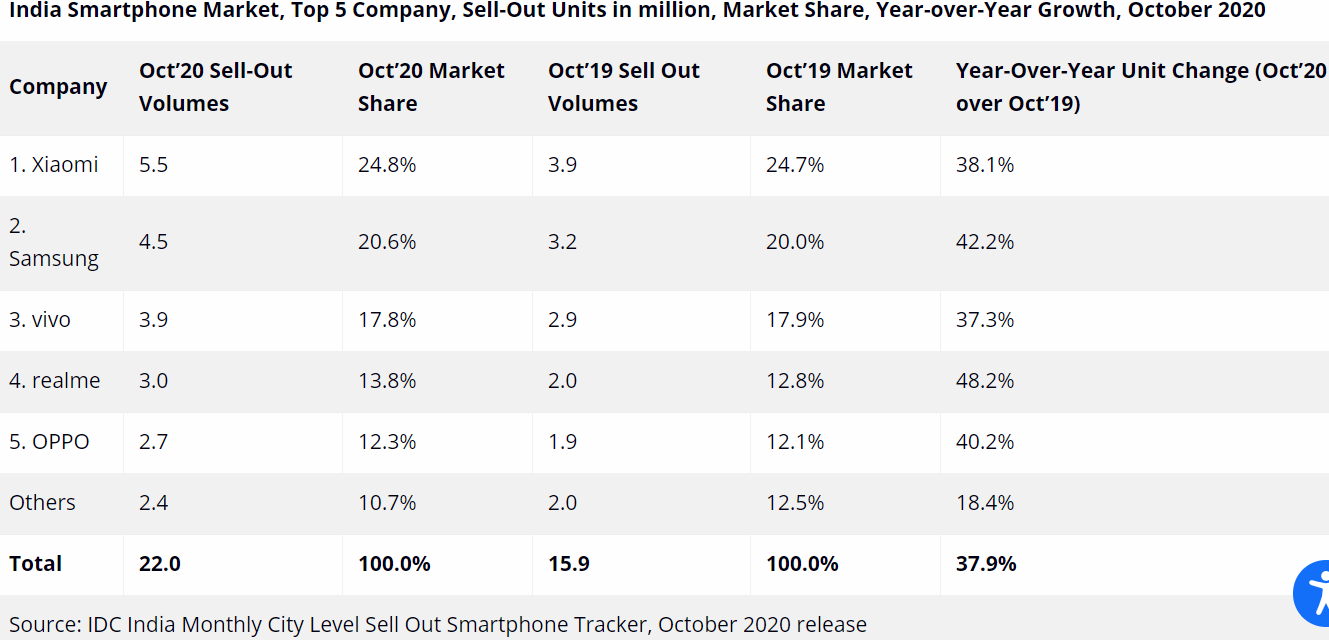

The Top 5 vendors remained unchanged compared to the previous quarter (3Q20): Xiaomi led, followed by Samsung, Vivo, Realme, and Oppo.

“Half a million 5G devices were sold, with almost 80% from the top 10 cities of India. Though 5G is a driver from a technological advancement standpoint, uncertainties on spectrum availability, clear use cases and high prices might restrict its uptake to few bigger cities initially," said Sachin Mehta, Market Analyst, Client Devices, IDC India.

Metros dominate sales

The IDC India Monthly City-Level Smartphone Tracker, which tracks sell-out units (final sale to consumers) for the leading 50 cities of India & the rest of the states, a record 22 million smartphones were sold in October, registering strong YoY growth of 38%.

The report said 25% of the market sat in top tier cities, namely New Delhi, Mumbai, Bengaluru, Chennai, and Kolkata, registering more than 50% YoY growth in October. E-learning initiatives fueled demand in bigger cities.

Bigger cities leaned heavily towards online channels, with 57% online share in the top 5 metros.

The next set of emerging markets, namely Jaipur, Gurgaon, Chandigarh, Lucknow, Bhopal & Coimbatore, also grew by 50% YoY.

However, the rest of the states (up-country markets) registered slower growth (avg. 25%), primarily owing to looming economic concerns and consumer spending narrowing to essentials only.

The leading 50 cities of India accounted for 55% demand nationally. The remainder is in the next set of evolving towns and cities, with huge untapped potential in the up-country geographies (feature phone-heavy markets).

Among the brands, Xiaomi led in 34 of the major 50 cities within the online channel. But Vivo led in 44 of the major 50 cities within the offline channel.

The premium segment ($500+) registered 16% YoY growth in October, with Apple leading the market in 49 of the top 50 cities. Further, this segment accounted for 5% market share in the leading 50 cities of India, compared to less than 1% in rest of cities.

Via: IDC

No comments